Records Retention Guide for Small Business Owners

Know What to Keep, How Long to Keep It, and When to Safely Shred It

Introduction

Keeping the right business records for the right amount of time protects you legally, financially, and operationally. Good record retention helps you:

Stay compliant with IRS and state requirements

Prepare for audits without stress

Keep your business organized

Reduce the risk of lost or missing documentation

Disclaimer: This guide is for informational purposes only and does not constitute legal or tax advice. Retention requirements may vary by state or industry confirm specifics with your CPA or attorney.

How to Use This Guide

Use the Quick Reference Table as your main resource.

Follow the general rules of thumb, but adjust for your state and industry.

Keep both physical and digital copies whenever possible.

Store originals of critical documents in a secure, fireproof location.

Retention Basics

IRS General Guidelines:

3 years: Minimum for most tax-related documents.

6 years if you do not report income that you should report, and it is more than 25% of the gross income shown on your return.

7 years: If you file a claim for a loss from worthless securities or bad debt deduction.

Indefinitely: If you don’t file a return or file a fraudulent return.

Definitions:

Permanent – Keep forever.

7 Years – Keep for seven full tax years.

4 Years – Payroll and employment tax records.

3 Years – Short-term records with no long-term impact.

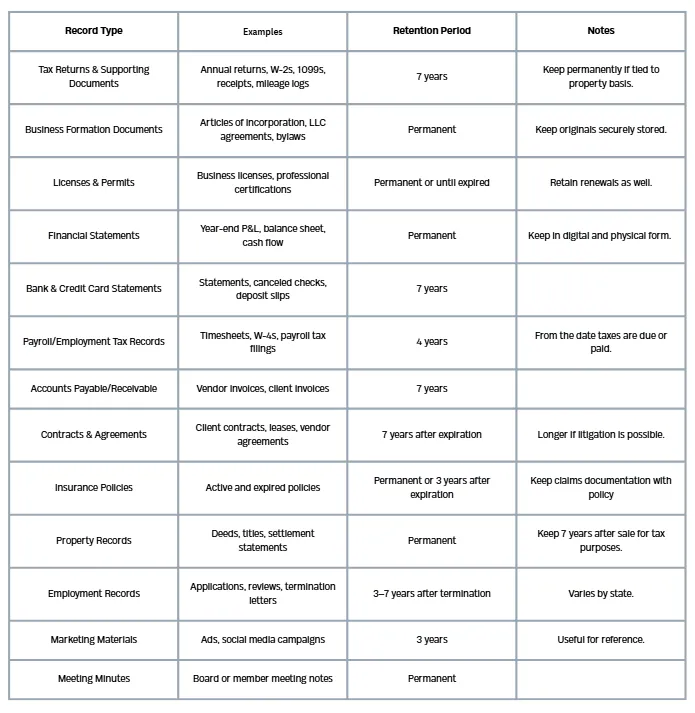

Quick Reference Retention Table

Special Considerations

Litigation Hold: If you’re involved in legal action, keep all related records until the matter is fully resolved, then follow normal retention rules.

Industry-Specific Rules: Certain industries (e.g., healthcare, construction, nonprofit) have additional retention requirements.

Property Transactions: Keep documents until the property is sold and the return for that year is filed + 7 years.

Storage & Organization Tips

Digital Storage: Use secure cloud storage with encryption.

Physical Storage: Store in labeled folders in a fireproof safe.

File Naming: Include date + document type (e.g., “2024-04 Vendor Invoice – ABC Supplies”).

Annual Review: Pick a month each year to review and purge outdated records.

Record Disposal & Security

Paper: Use a cross-cut shredder or professional shredding service.

Digital: Permanently delete files and empty trash/recycle bins; use secure wipe software when necessary.

Never throw sensitive documents in the trash without secure disposal.

Quick Action Checklist

Schedule annual record review.

Verify cloud backup and security settings.

Confirm compliance with state/industry retention rules.

Purge old records per the retention table.

Reflection Prompt

If you reviewed your record-keeping system today, what’s the one change that would make it more organized, compliant, and stress-free?

DISCLAIMER: While we strive to provide valuable guidance and support, individual results may vary and are dependent on factors such as individual effort and implementation. We are not liable for any outcomes resulting from the use of our services or products. Clients are responsible for their own actions and results.

- ©2026 All Rights Reserved .

Terms :Conditions- Privacy